Uranium can supply energy for the world’s electricity with less greenhouse effect than virtually any other energy source.

As the largest clean energy source, the development of nuclear power can ensure that the future generation’s energy demands are met effectively and efficiently. The strong long- term demand for uranium can be attributed to the energy needs of emerging countries in Asia, particularly China and India, that seek cleaner alternatives to fossil fuels.

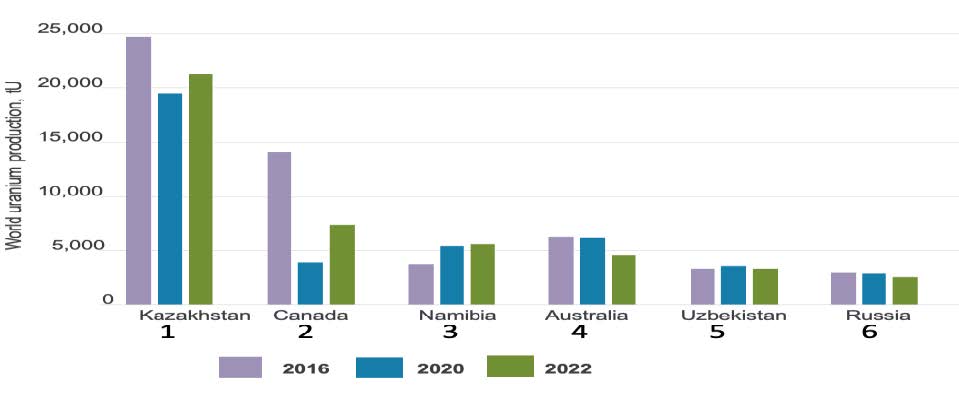

The following countries are the top producers of uranium, based on 2023 figures (world Nuclear Association):

The nuclear power industry is achieving increasing recognition for its clean energy credentials among policy makers, environmentalists and the public. Nuclear power continues to meet approximately 10% of the world’s electricity demand, and accounts for around 25% of the world’s low carbon electricity production as a low carbon reliable and secure source of generation it is expected to play a major role in future energy supply.

The key advantage of nuclear is its proven ability to provide reliable and economic base load power on a near zero carbon basis. In the USA, nuclear energy currently provides around 48% of the country’s carbon free electricity, an in the European Union it accounts for 40% of the region’s carbon free electricity.

The majority of countries have pledged to achieve decarbonization goals including China, Japan, the European Union, South Korea, UK and USA and the UN estimates that this represents more than 65% of global emissions.

In 2022, the world’s nuclear power plants applied 2487 TWH of electricity through 391 GWE of operable capacity. This avoided an emission of 2 billion tonnes of carbon dioxide compared to the equivalent amount of coal production in addition to total avoided emissions of around 78 billion tonnes since 1970. In the future, nuclear energy could contribute substantially more, given the expectation of rapidly expanding electricity demand. The transport sector offers great potential with electric vehicles are underway in numerous countries worldwide.

Geopolitical instability has prevailed over the last two years resulting from the Russia Ukraine war and this has led to increased interest in nuclear power for energy security and sovereignty and has significant implications for the global nuclear fuel market which is undergoing a fundamental shift. A global realignment is underway away from Russia in the nuclear supply chain where both in North America and in Europe, utilities suppliers and governments are pursuing opportunities to diversify supplies and transition from Russian provided services and an East/West bifurcated market is emerging as western utilities look for other long term contract sources.

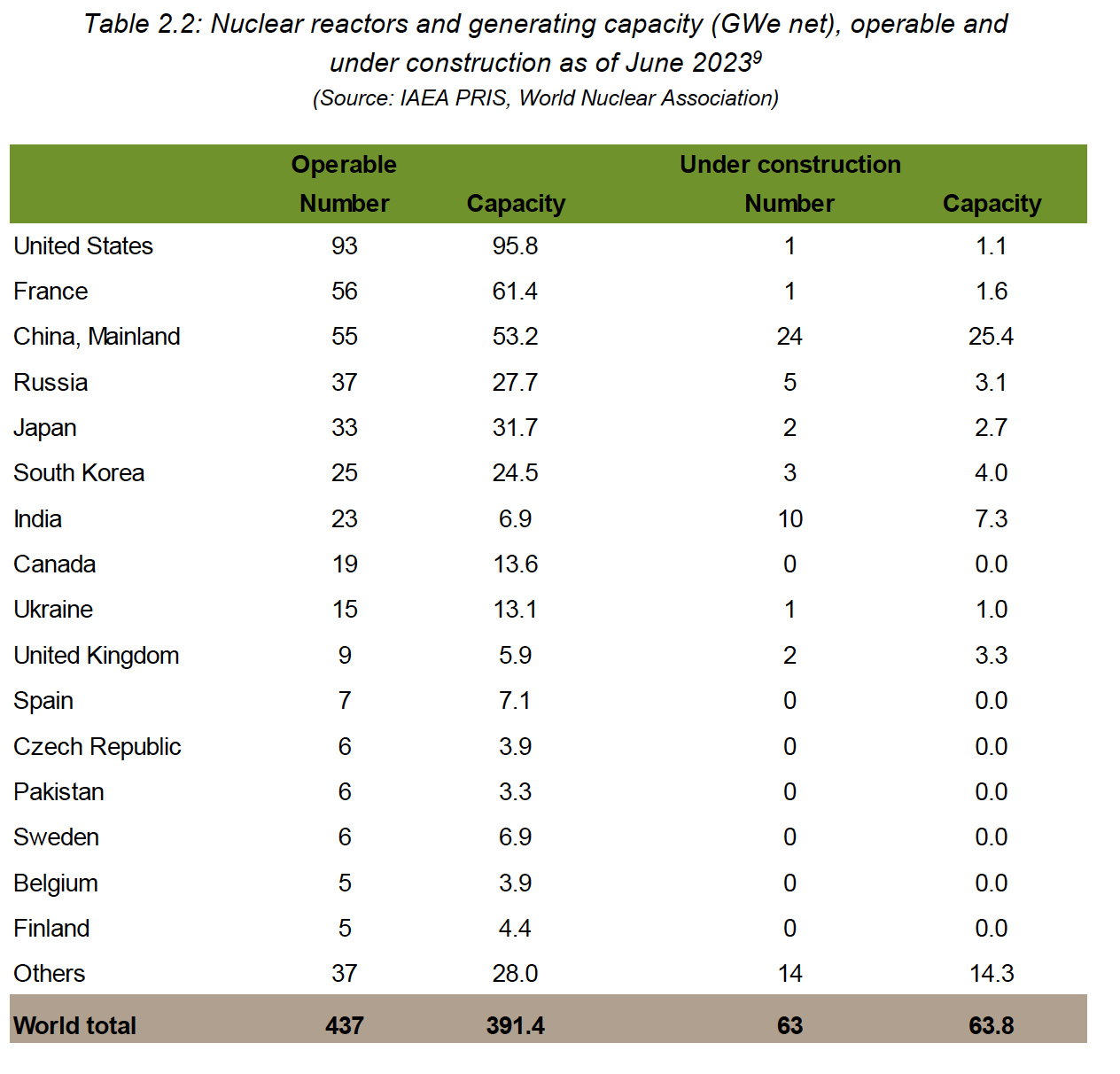

As of the end of June 2023, world operable nuclear capacity with 391 Gwe (from 437 units) and 64Gwe worth would come from 63 new units currently under construction. Over the last two years a total of 12 reactors have been connected to the grid in mature nuclear power nations including Belarus, China, Finland, Pakistan, Slovakia, South Korea, UAE and the USA. Additionally construction of new reactors has been started in China, Egypt, India, Russia and Turkey and Iran and many other countries are considering either to expand their existing nuclear programmes e.g. Bulgaria Czech Republic, France, Hungary, Netherlands, Romania, and the UK or to build their first reactors e.g.Ghana, Kazakhstan, Kenya, Poland, Saudi Arabia, Uganda. In two of the larger industrial nations (China and India) nuclear capacity growth is expected to increase significantly with over half of the projected new reactors in these two countries alone.

World uranium production has significantly declined over the last few years, due to mine curtailment and previously during the covid pandemic, required producers to make spot market purchases to meet contractual obligations. The industry trade association noted that “world uranium production dropped considerably from 63,207 tonnes of uranium (tU) in 2016 to 47,731 tU in 2020 with the expectation that the uranium market will remain in worsening deficits (-25mlb annual average).

However, primary production of uranium from mines, conversion and enrichment plants continue to supply the majority of the demand for nuclear reactors around the globe and in the near-term secondary supplies of uranium will continue to play a role in bridging the gap between supply and demand. However, secondary supply is projected to have a gradually diminishing role in the world market decreasing from the current level in supply 11 to 14% of reactor uranium requirements to 4 to 11% in 2014 world reactor requirements for uranium in 2023 estimated at about 65,650 tonnes in the WNA 2023 reference scenario these are expected to rise to 83,840 tonnes in 2030 and almost 130,000 tonnes in 2040 to meet the additional demand for new nuclear power plants. The World Nuclear Association (WNA) estimate that production is only meeting 74% of usage requirements and that this supply demand gap will only widen over the next 20 years1.

To meet the reference scenario in the WNA 2023 review, in addition to restarting idled mines, planned mines and other new projects will need to be brought into production. Considerable exploration innovative techniques and timely investment will be required to turn these resources into refined uranium ready for nuclear fuel production within this timeframe two 2040.

Governments are in the process of re-establishing nuclear programmes. Today there are 437 nuclear power plants operating worldwide in 33 countries with a further 63 nuclear reactors currently under construction3. The lower operating cost of nuclear power generation and the increasing concern for the environment and climate change are driving this nuclear renaissance. There are now 514 new reactors planned around the world plus a new generation of Small Modular Reactors (SMRs) which offer a lower initial capital investment, greater scalability, and siting flexibility for locations unable to accommodate more traditional larger reactors. They also have the potential for enhanced safety and security compared to earlier design.

Proposed reactors are 475 with 154 of these in China alone

The projected expansion of nuclear power generation will lead to a corresponding demand for primary uranium production. There is no doubt that sufficient uranium resources exist to meet future needs. However, producers have only just re-emerged having waited for uranium prices to improve and have started investing in new capacity and bringing idled and shutdown projects back to production. With changes in government policies, the uranium market has begun to recover.

Most of the countries that use nuclear-generated electricity do not have sufficient domestic uranium supply to fuel their reactors and therefore they secure the majority of their required uranium supply by entering into medium-term and long-term contracts with foreign uranium producers and other suppliers. Remaining supplies are secured through spot purchases of uranium.

Uranium Supply, Demand and Pricing

During the last two years, as producers suspended production due to COVID-19 lockdowns and then purchased uranium in order to meet contractual obligations, the spot price declined to a low of US$27.98/lb on February 28, 2021 and has since recovered reaching a high of US$72.68/lb on October 2, 2023. On September 30, 2023, the uranium spot price was US$71.58/lb.

While the uranium spot price can be volatile, the majority of uranium sales occur under long-term contracts with the long-term contract price having moved upwards to US$61.50/lb on September 30, 2023 (UxC). Notable recent contracts include China General Nuclear and China General Nuclear Power Corporation who have entered into new purchase agreements for three years between 2023 and 2025 for 3.12 million lbs of U3O8 per year with 40% of the contract quantity fixed at US$61.78/lb, materially higher than the prevailing spot price of US$46/lb when the contract was signed and also above the UxC reported long-term contracts price of US$53.50/lb. However, activity in the global spot market declined slightly during June, with UxC reporting a total of 3.4 Mlbs transacted as compared to 3.8 Mlbs during May 2023. Total spot market volume for 2023 now stands at 27.0 Mlbs.

Uranium prices have also been impacted by the increased activity by investment firms acquiring physical inventory for storage. Existing market participants such as Yellowcake Plc have continued to acquire physical inventory. As at September 30, 2023, Yellowcake Plc took delivery of a further 1,350,000 lb pursuant to the previously announced exercise by the Company of its 2022 uranium purchase option under its Framework Agreement with Kazatomprom. Yellowcake Plc holds 20.156 million lbs of U3O8. Sprott Physical Uranium Trust has also been very active and as of September 30, 2023 had acquired 62.21 million lbs of U3O8 overall, thereby increasing its holding since June 2022 by 5.51 million lbs of U3O8.

1https://www.world-nuclear-news.org/Articles/Nuclear-fuel-report-sees-positive-long-term-future